michigan sales tax exemption rules

There are certain tax exemptions for people who own farms and work in agricultural production but to claim the exemption you must meet the requirements for qualification. For Resale at Wholesale.

Sales Tax For Small Businesses Truic

Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520.

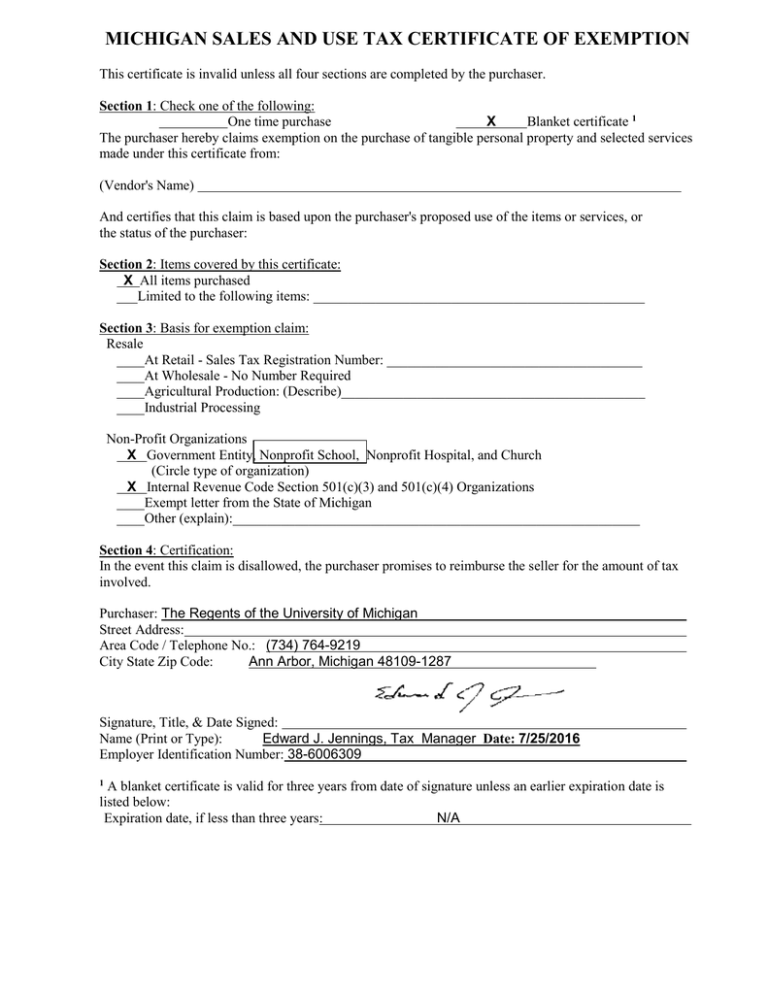

. Direct Purchases by MSU The Michigan Sales and Use Tax Certificate of Exemption should be completed and submitted to the vendor only when the payment is being made directly by MSU. The word acquire is defined in Blacks Law Dictionary 8th ed to mean to gain possession or control of. The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the University of Michigan.

These fees are separate from. The Michigan Department of Treasury recently issued Revenue Administrative Bulletin RAB 2019-15 revising its guidance regarding the application of several new sales and use tax laws to the construction industry. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

New State Sales Tax Registration Application Exemption. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. The following exemptions DO NOT require the purchaser to provide a number.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Ad Sales Tax Exemption Michigan registration application for new businesses. According to the General Sales Tax Act Section 20554s a sale of investment coins and bullion is exempt from the sales tax.

T 1 215 814 1743. Certificate must be retained in the sellers records. An additional personal exemption is available if you are the parent of a stillborn child in 2021.

Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. It cannot be used when the employee makes the purchase with personal funds and then seeks reimbursement from MSU.

In Michigan certain items may be exempt from the. Additional sales excluded from tax. The small business taxpayer personal property exemption provides a complete exemption from personal property tax for industrial or commercial personal property when the combined true cash value of all industrial personal property and commercial personal property owned by leased by or in the possession of the owner or a related entity claiming the exemption is less than 80000.

Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. Sales of vehicles to members of armed forces. 20 rows Sales Tax Exemptions in Michigan.

No tax is due if you purchase or acquire a vehicle from an immediate family member. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. The state also provides a 2800 special exemption for each tax.

Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Rankings by State Sales Tax Only. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax.

Streamlined Sales and Use Tax Project. 09-18 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. To claim the exemption complete Form 3372 found on the Sales and Use Tax Information page on the Michigan Department of Treasury website.

Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product. Exempt from sales or use tax to a use that is not exempt from tax Acquisition of tangible personal property does not automatically subject a contractor to Use Tax liability. Sales tax is set at 6 percent in the state of Michigan for all taxable retail sales with some concessions however.

The Michigan Liquor Control Code defines a wholesaler as a person who sells beer wine or mixed spirit drink only to retailers or other. Rules and Regulations for the State of Michigan. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

Tax on sale of food or drink from vending machine. Tax Exemption Between Relatives If you purchase or acquire a vehicle from another person 6 tax is due of the full purchase price or fair market value whichever is greater. The law defines bullion as gold silver or platinum in a bulk state where its value depends on its content rather than its form with a purity of not less than 900 parts per 1000 Investment.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. DO NOT send to the Department of Treasury. Sales exempt from tax.

House Bill 4540 would specify that record-keeping requirements for tax exempt sales would not apply to a person licensed as a wholesaler by the Michigan Liquor Control Commission who sold alcohol to another person licensed by the commission. This certificate is invalid unless all four sections are completed by the purchaser. Michigan Documentation Fees.

425 percent and the personal exemption is 4900 for each taxpayer and dependent. Commissions paid to entities exempt under MCL 20554a. Average DMV fees in Michigan on a new-car purchase add up to 230 1 which includes the title registration and plate fees shown above.

To get or obtain. Acquisition is not equivalent to ownership. Background Over the past several years the Michigan legislature has been active in addressing the Michigan.

Heres an excerpt about Sales Tax Sales Tax Purchases When a charity purchases items to help them carry out their charitable purpose they are exempt from paying Michigan Sales Tax. Michigan Department of Treasury 3372 Rev. Michigan offers sales tax exemptions to people working in agriculture.

This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Do not send a copy to Treasury unless one is requested.

Michigan Department of Treasury 3372 Rev.

Michigan Sales Tax Small Business Guide Truic

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

Download Policy Brief Template 40 Brief Policies Ms Word

Free Online 2019 Us Sales Tax Calculator For Michigan Fast And Easy 2019 Sales Tax Tool For Businesses And People From Michigan United Sales Tax Tax Michigan

Sales Taxes In The United States Wikiwand

When Is Sales Tax Due On A Lease

Michigan Sales And Use Tax Certificate Of Exemption

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Ebay Taxes An Overview Guide Quickly Learn Everything You Need To Know

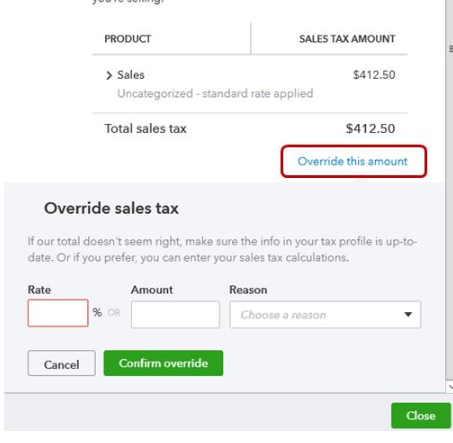

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Us Sales Tax Sales Tax Nexus A Complete Guide

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

If You Don T Have Nexus And Don T Charge Sales Tax Are You Liable If The Customer Does Not Pay The Tax Sales Tax Institute